It’s a proactive measure that helps avoid the pitfalls of reactive spending, which can lead to budget deficits and fiscal stress. Overall, encumbrance accounting serves as a crucial tool for effective budget management, accurate financial reporting, informed decision making, and maintaining financial control and accountability. By utilizing encumbrance accounting practices, organizations can optimize their financial resources, enhance transparency, and foster fiscal responsibility. From the perspective of budget officers, encumbrance accounting provides a real-time view of committed funds, allowing for better cash flow management and minimizing the risk of budget encumbrance budget overruns.

Want to Pass as Fast as Possible?

Similarly, the PO obligation is released only when the Invoice is validated and approved. Badly needed your help because we are in the implementation stage of budgeting module. It means that some party has placed a claim on the property that affects what the property owner may do with it. A restrictive covenant is an agreement that a seller writes into a buyer’s deed of property to restrict how the buyer may use that property.

Encumbrance accounting: Definition, process, and importance

Encumbrance accounting helps companies manage their finances better and save for a rainy day. With encumbrance accounting, organizations record anticipated expenditures beforehand. This encourages transparency and increased visibility in how the budget is being allocated and how money is being spent. As a result, organizations can track their expenditures against the allocated budget more effectively. This type of budgetary control is required in both government accounting and nonprofit accounting since future expenses need to be accounted for properly to ensure that money is available. While encumbrance accounting presents several challenges, the solutions largely lie in leveraging technology, enhancing communication, and providing education.

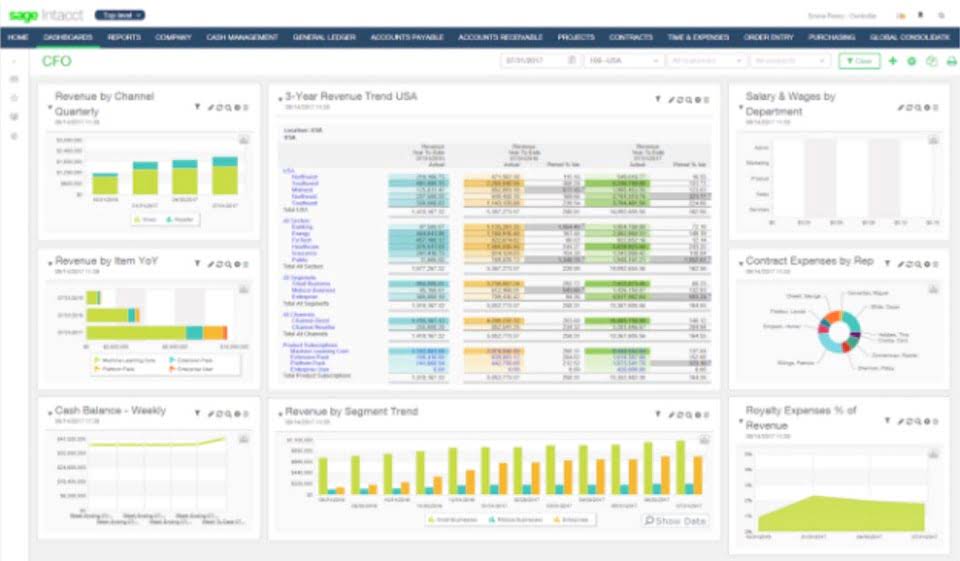

The 10 Best Accounting Software Solutions for Educational Institutions

Encumbrance accounting is a budgeting technique that can revolutionize the way governments manage and allocate funds. By earmarking funds for specific purposes before they are actually spent, encumbrance accounting provides a framework for more disciplined and transparent financial management. This method allows for a clearer understanding of where funds are committed, reducing the likelihood of overspending and ensuring that money is available when needed for its intended purpose. As we look to the future, the adoption of encumbrance accounting in government budgeting is poised to offer several transformative benefits. Unlike traditional accounting methods, which only track funds as they are spent, encumbrance accounting monitors committed funds before they are actually disbursed. This approach provides a more accurate picture of available funds at any given time, preventing departments from committing to expenditures that exceed their budgets.

- Understand the role of encumbered funds in effective financial planning and how they influence budgeting and public finance management.

- The funds allocated for the purchase can now not be used for any other purpose or aren’t taken back from the encumbrance account by the company.

- If this change resultsin a transaction that is no longer controlled by the original budget,you must change all relevant transactions to reference the budgetin its new location or to reference a new detail budget.

- Altering a transactionthat has been through budget checking results in the deletion of allexisting exception rows for the transaction.

The auditor will also need to conduct a review of current governmental funds, particularly special revenue funds. Our platform helps you simplify your AP and AR processes, eliminating manual errors and allowing for better tracking of your payments and vendors. Routable provides a complete audit trail to help lower fraud and compliance risk and helps increase visibility through this thorough https://evehost.co.za/what-is-a-w-8ben-e-form-and-who-needs-to-file-it/ tracking. We also allow you to process your invoices and payments your way, whether that means email, scanning, or automatically forwarding bills from your email.

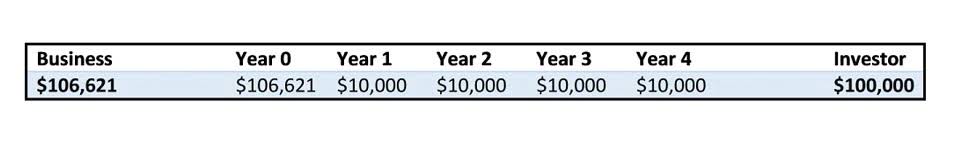

- If the project ends up costing only $90,000, the remaining $10,000 is released from encumbrance and can be reallocated.

- It allows for better financial planning, promotes fiscal responsibility, and enhances transparency and accountability.

- This method provides a clear picture of the government’s available budget at any given time, preventing overspending and promoting fiscal responsibility.

- The recording and reporting of encumbrances may vary depending on the specific accounting standards and practices followed by an organization.

- By anticipating future needs and preparing for various scenarios, governments can create a more stable financial environment that benefits all stakeholders.

Improved planning

At the end of the year, if you have a balance remaining in the encumbrance reserve account, you’ll need to determine if those commitments are still valid or if they will need to be adjusted. However, the amount is recorded as an encumbrance immediately, reserving that $50,000 for the upcoming expense. Once the equipment arrives and is invoiced, the encumbrance is lifted and replaced with an actual expense. Manually create a budget plan and submit it to workflow to be routed through your organization for review and approval.

- Or pedestrians might have the right to use a footpath passing through that property.

- With Encumbrances, no payments leave the University and no actual expense would be generated on a ledger, since it is an expectation of a future actual transaction.

- Once the vendor approves the transaction, the commitment converts into a legal obligation.

- This encourages transparency and increased visibility in how the budget is being allocated and how money is being spent.

- To illustrate how the complete encumbrance accounting process works, let’s take a typical example of an encumbrance transaction — a purchase order.

- Governmental accounting operates under a distinct framework compared to private sector accounting, primarily due to its focus on accountability for public funds rather than profit generation.

Smart Strategies in Data Security and Risk Management

The following terms are primarily and widely used in this accounting – Commitment – Money that is committed to spending in the future is called commitment. In Oracle, it is the money committed to being spent on a purchase requisition document. These are just a few examples of the types of encumbrances that organizations may encounter.

Best Practices for Managing Government Encumbrances

The accounting treatment for encumbrances involves several steps that ensure financial commitments are accurately reflected in an contra asset account organization’s records. When an encumbrance is first recognized, it is recorded in the accounting system to reduce the available budget. This initial entry typically involves debiting an encumbrance account and crediting a budgetary control account. This process effectively earmarks the funds, signaling that they are no longer available for other uses.